There are national down payment direction applications provided by one another bodies and private organizations. You will find both fund and has offered in the united states. Will ultimately, there might be a national taxation credit for home buyers out-of Biden’s $15,000 basic-time homebuyer taxation borrowing.

Simultaneously, this new Biden Deposit Towards Collateral Work may offer a good $twenty-five,000 federal grant so you can buyers to acquire its very first household. Agencies provide all over the country software, including the Lender out-of The usa House Give Program as well as the Bank of America Deposit Offer System.

Condition programs

County downpayment guidelines apps tend to be more numerous than national applications since county, state, and you will urban area governments often bring or recruit down payment applications. Personal organizations supply a whole lot more software that are geared towards specific elements.

Such as, the town of Boulder even offers a give so you’re able to customers from inside the Boulder, Tx which offers to 5% of the home cost inside the downpayment assistance. The Tx Homes Advice Organization also provides financing for approximately $20,000 to cover advance payment and you will closing costs to possess Tx family buyers.

You can find programs like this in almost any condition. It indicates you may have far more alternatives for downpayment guidelines than you possibly might comprehend.

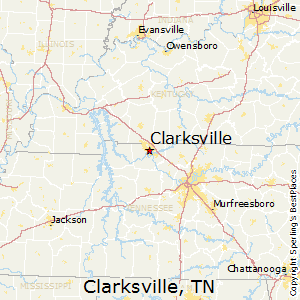

You may be in a position to buy a home which have $twenty-five,000 income your location, so long as you are happy to move around in at least some time. Demonstrably, certain areas are more sensible as opposed to others. Even the most affordable claims to find a home have high priced and you can low priced portion.

The causes some states be much more affordable than the others and several portion contained in this for each condition be sensible as opposed to https://paydayloanalabama.com/waterloo/ others are many.

For example, Their state is one of the most expensive claims to acquire an excellent family once the you will find not a lot of room to build homes into the Their state, thus there is certainly a highly minimal source of homes. Likewise, California is costly while they features large condition tax prices.

Yet not, even yet in high priced claims, discover inexpensive elements. There are almost certainly sensible components apparently close to where you are already lifestyle. With a little looking and you may downpayment guidelines, you are able to afford a property close to where you reside.

To purchase a home on a finite money is possible. But you will need to do a little bit of planning and come up with yes you know the possible home buying costs, thus you aren’t surprised by one thing.

Control your present obligations

Since you may provides guessed in accordance with the loans-to-income ratio section away from before on this page, handling your current loans is important for finding a home financing. Paying off financial obligation try a guaranteed way to alter your current debt-to-earnings proportion.

Although not, there are activities to do to aid lower your financial obligation-to-money ratio shorter. You might discuss a diminished rate of interest towards credit cards, when you yourself have credit card debt. Education loan repayments is restructured. Auto payments is also refinanced to help you a diminished rate of interest.

If you’re such methods won’t treat obligations altogether, they could change your obligations-to-earnings proportion from the reducing your requisite financial obligation payments, which will surely help you earn recognized getting a mortgage actually in advance of you’ve totally paid off your current financial obligation.

Understand how your credit score affects interest levels

Your credit score has an effect on just what rates of interest you qualify for. A far greater credit rating qualifies your to possess all the way down interest rates, so that you rating straight down month-to-month home loan repayments while pay less desire along the life of the mortgage loan.

In addition to, downpayment recommendations apps normally wanted at least credit rating ranging from 600 and you will 640. A far greater credit history will give you significantly more entry to down payment recommendations.

Lascia un commento